Economic classification is the grouping of the costs according to their economic content.

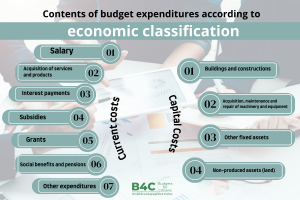

Under this classification, costs are distributed according to 2 main categories:

- current costs

- capital costs (expenses on non-financial assets).

These, in turn, are split according to separate directions /see below/.

Based on the objectives of the research, the economic classification can be used to present both the nature of the total expenditures of the state budget, the structure of expenditures of individual departments, and the types of expenditure interventions implemented within the framework of individual budget programs and/or measures as well as various options for organizing.

In the case of total budget expenditures, it is important to present the ratio of capital and current expenditures. At the same time, the object of analysis can also be the capital expenditures made only at the expense of internal resources (without external assistance).

It should be kept in mind that according to the fiscal rules established by the RA Law “On the Budget System”, when ratio of debt/GDP of the government exceeds 40 %, capital expenditures should not be less than deficit of the state budget. For example, in 2021, the government debt exceeded 60 % of GDP, amounting to 60.3%. For example, in 2021, the government debt exceeded 60 percent of GDP, amounting to 60.3 percent. Accordingly, the projected capital expenditures in 2022 was AMD 351.9 bln (of which AMD 221.6 bln only at the expense of budgetary resources), and the deficit was AMD 236.6 bln.

Depending on the objective of the analysis, each of the cost components can be studied and presented separately in the structure of both current and capital costs.

For example, in the case of administrative/ maintenance expenditures, the salary fund of the given body may be of interest; in the case of capital expenditures – the level of financing of purchased vehicles or any other equipment; financial resources allocated for capital repairs of the state body, and etc.

Subsidies and grants are one of the most important components of current expenditures of the state budget.

The analysis of the latter allows understanding the gratuitous and non-refundable financial support provided from the state budget to communities, state and non-state organizations, individuals, as well as international partners.

Grants to communities can be in the form of grants and subsidies.