Economy is the main source of revenues of the state budget, which includes: taxes and other revenues collected from citizens and businesses, as well as official grants received from international organizations and foreign governments.

Budget revenues are usually divided into tax and non-tax revenues. Tax revenues are those incurred from direct and indirect taxes of citizens and companies, as well as from duties. Non-tax revenues, as the name suggests, are not generated from taxes, but they are various grants and donations, income from state-owned enterprises, rent from state property, etc.

The main approaches to the analysis of state budget revenues are studies of the structure and dynamics of revenues.

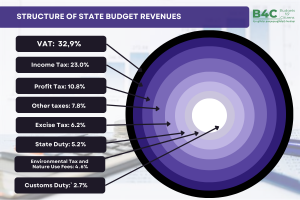

It is important to present the structure of tax revenues and fees by types, as well as the structure of grants by donors and objectives.

In addition to the structure of budget revenues, it is also necessary to highlight/identify the specific type of revenues from which taxes increased during the period under study, as well as the economic development impulses it contains.

For example, in the structure of the RA Annual Budget in 2022, “tax revenues and state duties” totaled to only 93.4 percent of revenues, and the official grants to 0.7 percent. The role of VAT, income tax and profit tax is particularly important among the tax revenues.

When analyzing revenues, it is also important to analyze budget assistance grants, their structure and the donors. Grants can be general or targeted (intended for use for a specific objective).

Donors providing grants to the Republic of Armenia – governments and international organizations – are numerous.

For example, the key major donors in 2022 were the EU, the World Bank and the Global Fund. Moreover, general assistance was provided by the EU, the United Nations and the World Bank. Targeted assistance amounted to only 41.7 percent of the grants provided.

Introducing the targeted aid area/sector is also important for understanding the directions of foreign aid.

The budget revenue analysis can also be combined with expenditure analysis to assess whether the domestic revenues collected by the government are sufficient to finance major programmes. That is, only the size of domestic income may be discussed and compared with different levels of expenditures.